Tesla’s Model Y went on to become the best-selling car in the year 2023 with a total sale of an astonishing 1.23 million units delivered worldwide. This stylish newcomer to the Tesla fleet proved to be even superior to such hitherto industry leaders as Toyota Corolla and Rav4.

Increased Incentives as Tesla Grapples with Unsold Inventory

However, just as the electric giant appeared to be invincible, a rather unusual event occurred at the start of 2024. It was the first time since the second quarter of 2020 that Tesla faced a drop in deliveries, leaving behind a mammoth number of cars waiting to find their owners. To address this emerging issue directly, Tesla dared to cut prices and offer a deluge of promotional offers to clear the excessive stock.

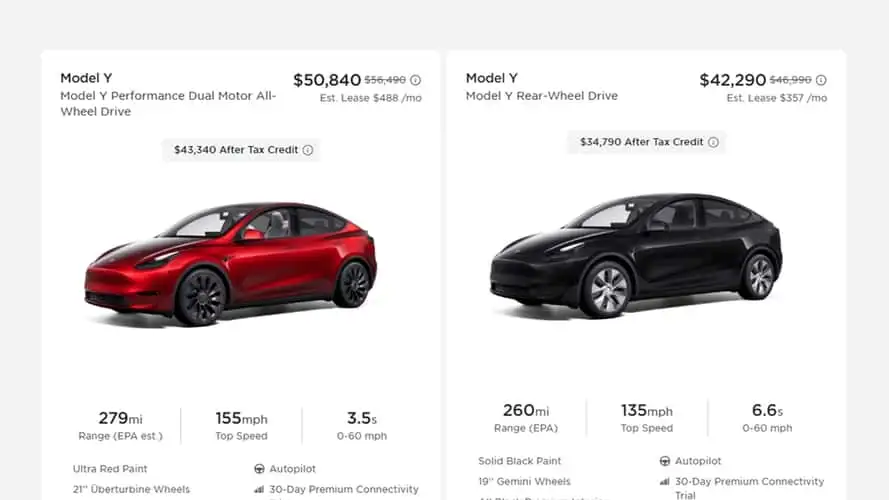

Breaking Down the Potential Tesla Model Y Lease Deals

Img Credit- Cardekho.com

YouTuber Bearded Tesla Guy then went over these incentives and how they apply to leasing specifically. They proposed that a buyer who would like to lease a Model Y Rear-Wheel Drive (RWD) could possibly get into a 36-month Tesla Model Y lease at $282 per month with $2,999 down payment, though this is excluding state taxes and registration fees.

Here’s how the deal breaks down:

The federal tax credit of $7,500 is reported directly to the lease.

The Model Y RWD that is available is the one that is discounted by $4,400.

Another $1,000 is added as a down payment for Cybertruck reservation owners.

Hidden Costs and Effective Monthly Payments

The attractive lease payment may be beneficial but one must consider the following factors. If the down payment, taxes, title fees, and license fees are incorporated, the cost per month is often more than $300, and often goes as high as $400 and above.

State EV Incentives to the Rescue

But there is good news for those who might be willing to accept longer lease terms or less convenience. Many states also have their own incentives for EVs that can go a long way toward cutting the price. For instance, the $5,000 state incentive available in Colorado is able to bring the effective monthly cost back into a more reasonable bracket.

Image source: INSIDEEVS

Not a Tesla-Exclusive Practice

However, I want my readers to know that Tesla is not the only car maker that allows the $7,500 federal tax credit on leased cars. Hyundai and Kia have been doing the same by designating the leased EVs as ‘commercial vehicles,’ thus qualifying for the tax credit.

Scrutinizing the Fine Print

Although these kinds of agreements may appear rather attractive, one has to be cautious and read the small print. One point of consideration is the money factor on Tesla leases, as some buyers with good credit score have fled dealership deals when the money factor was above 0. 0042 which can be interpreted as approximately 10% interest after making the final adjustments.

Another issue is that Tesla does not let lessees buy the car at the end of a lease period. Therefore, options such as Enhanced Autopilot or Full Self-Driving – Supervised (FSD) should not be leased with the vehicle since they cannot be transferred to the lessee after the leasing period is over. However, if FSD is mandatory, then the $199 month-to-month subscription might serve as a more realistic solution while costing nearly double the monthly payment.

Conclusion

Tesla faces challenges with inventory surpluses and their incentives and lease options still allow buyers to get certain attractive offers for the highly popular Model Y; at the same time, it is essential to understand all the costs, possible incentives, and possible pitfalls to make the right choice.

FAQs

Q1: What is the lowest potential monthly payment for a Tesla Model Y RWD lease?

Amidst the whirlwind of incentives, including the enticing $7,500 federal tax credit, a substantial $4,400 discount on the Model Y RWD, and an additional $1,000 Cybertruck reservation holder discount applied towards the down payment, the advertised monthly lease payment tantalizes at a mere $282 over 36 months. Yet, as the dust settles and reality creeps in, the true cost reveals itself, surging significantly with the inclusion of down payments, taxes, title fees, and license fees.

Q2: How can state incentives impact the overall cost of a Tesla Model Y lease?

In the maze of EV incentives, certain states add an extra layer of intrigue. Take Colorado, for instance, where a generous $5,000 state incentive dances into the equation, potentially slicing through the leasing costs of a Model Y with precision. This additional perk injects a burst of affordability into the equation, shaping a new narrative for the effective monthly lease, shrouded in intrigue and possibility.

Q3: Is Tesla the only automaker applying the $7,500 federal tax credit to leased EVs?

Tesla is not the only automaker that is doing so. Hyundai and Kia in particular have been using the $7,500 federal tax credit for their leased EVs by labeling them as ‘commercial vehicles.’

Q4: What should buyers be cautious of when reviewing Tesla’s lease terms?

The buyers ought to focus on the money factor (interest rate) in the Tesla leases. A few buyers have been turned off when the money factor was more than 0.0042 which refers to approximately ten percent interest after final adjustments.

Q5: Can you purchase the Tesla Model Y at the end of the lease term?

No, as of now, Tesla does not offer such possibility for lessees to either purchase the car at the end of the lease term. This is why it is wiser not to add costly options, for instance, Enhanced Autopilot or Full Self-Driving – Supervised (FSD) to the lease because you cannot retain them after the lease expires.

Amit Gupta is an extreme environmental enthusiast and a passionate EV blogger who completed his B.Tech in Computer Science. He explores the emerging environmental technologies and discoveries in EV sector, sharing his valuable insights and tips on his blog which are based on his personal experiences. Through his articles, Amit Gupta aims to simplify the complex EV sector concepts and empowers his readers to make accurate decisions in our rapidly changing world. Follow him on Facebook and linkedin to stay updated on his latest posts.